To issue electronic rental receipts, it is necessary to immediately communicate the relevant contract (lease, sublease and promise to lease) to the Revenue and Customs Agency (AT), by submitting the Model 2 declaration, by the end of the month following its start.

Issue electronic rent receipts

Who gets fired

- They are over 65 years old

- They receive an amount of income less than double the annual IAS, equal to 960.86 euros and, cumulatively, they do not own nor are required to have an email address;

- Receive rent from contracts covered by the Rural Rental Scheme.

How is the receipt issued?

To issue electronic rent receipts you must comply with the following: the following steps:

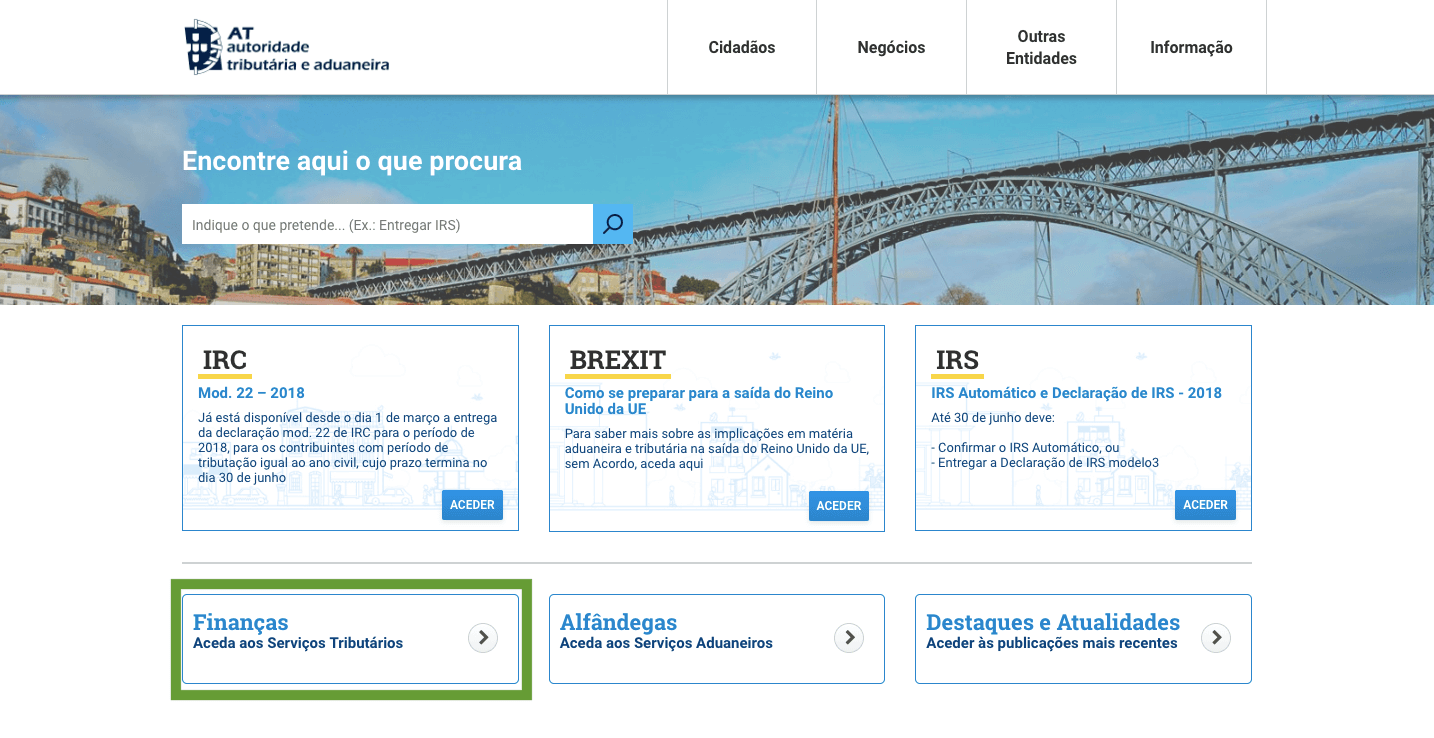

1. Log in to the Financial Portal

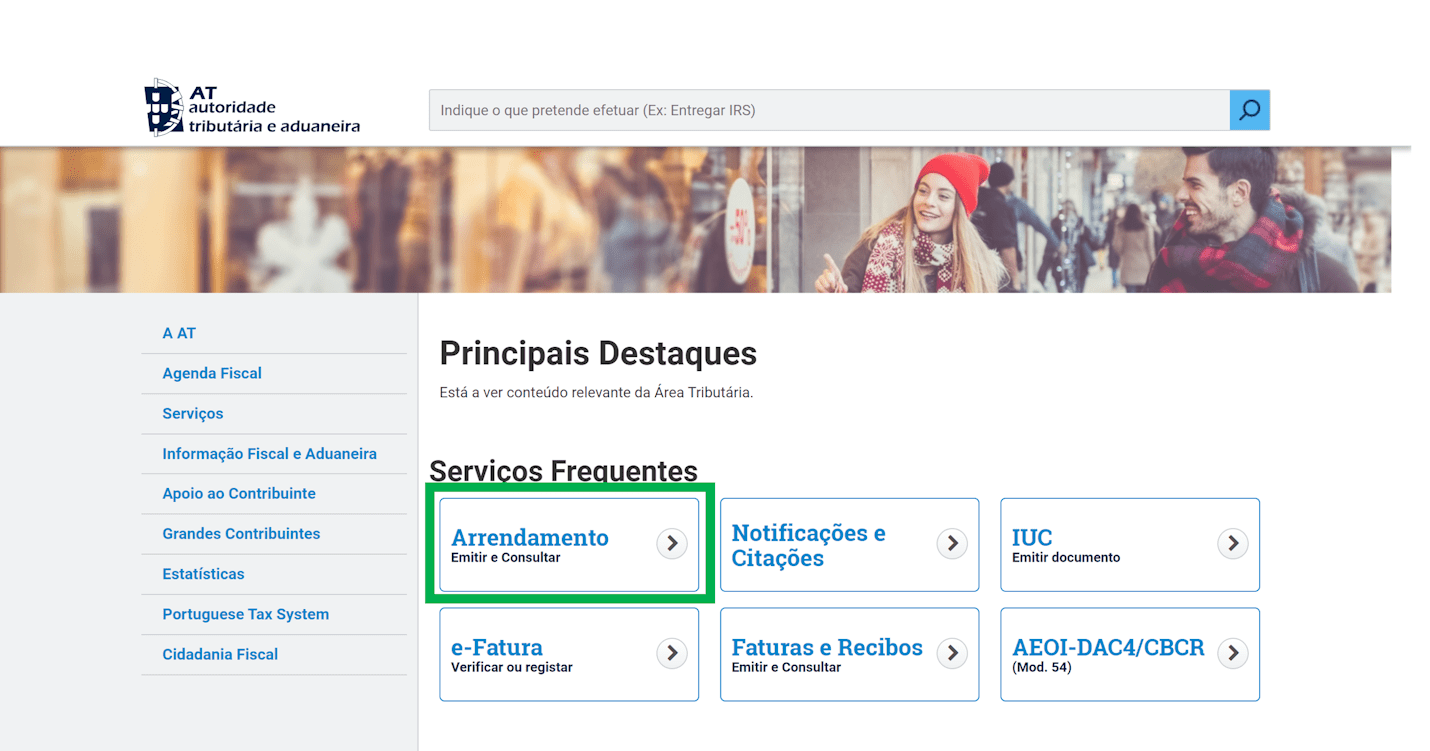

2. Click on the «Finance» option.

3. Choose the «Location» option.

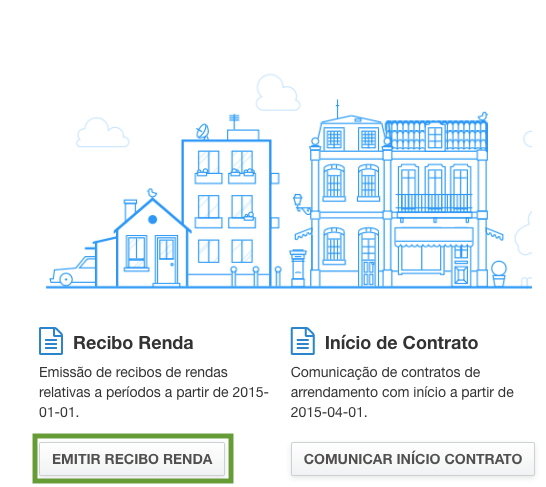

4. Click on the “Issue Income Receipt” option.

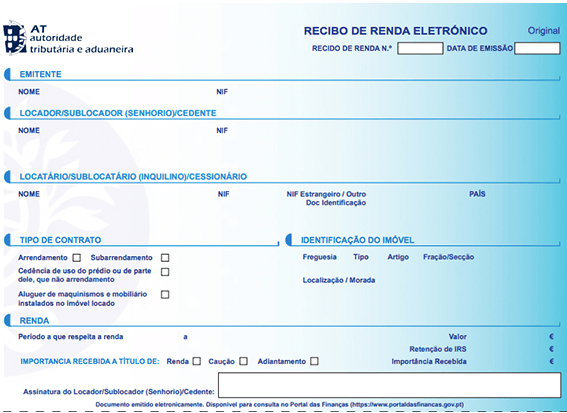

5. Choose the contract for which you want to issue a receipt.

6. Fill out the receipt. The name of the lessor or of the person authorized by him to do so on his behalf must be reported in the «Issuer» field.

How to cancel the receipt?

latest posts published

What is botulism: everything about this dangerous disease

How to clean and care for your baby’s belly button?

How to detect and treat gastroenteritis in children?

At what age do the most common types of cancer appear?

Dyslexia in children: what is it, diagnosis and treatment?

Canker sores in children: symptoms and treatments

7 activities to do during the Christmas holidays with children

Self-employed: how much you will pay to Social Security

Know your rights and responsibilities as a worker