1 – Disabled taxpayer

> Deduction: 25% of premiums with a limit of 15% of proceeds

According to the Section 87 of the IRS Codea taxpayer with a disability can deduct from their IRS 25% of the premiums paid for life insurance with coverage in the event of death or disability. However, this deduction cannot exceed 15% of the total value of the collection.

If earmarked for retirement, like PPR, 25% of premiums paid for life insurance can be deducted by the IRS. The limit for this deduction, however, is 65 euros for individuals who are not married or legally separated and 130 euros for individuals who are married and not legally separated.

The IRS Code defines persons with disabilities as those who are assigned, by an authorized body, a degree of permanent disability equal to or greater than 60%.

2 – Professions that wear out quickly

> Deduction: 100% of premiums with a limit of €2,178.80

OR Section 27 of the IRS Code believes that sportsmen, miners and fishermen are professions that are rapidly disappearing.

Members of this group can deduct 100% of premiums paid on life insurance with the IRS, covering contributions in the event of death, disability or retirement. However, there are some conditions to be respected:

- Life insurance must only cover the risks of death, disability or retirement due to old age. In the case of an old age pension, the life insurance must guarantee the benefit after the age of 55;

- Life insurance cannot guarantee the payment of any residual capital and this must not happen, in particular, by redemption or advance, during the first five years.

This deduction, however, is limited to five times the social support index (IAS) per taxpayer. In 2019, according to Ordinance 24/2019, the IAS is equal to 435.76 euros. Therefore the limit of the deductible will be equal to 2,178.80 euros.

3 – Insurance that contributes to your pension

> Deduction: 20% on premiums with a maximum limit of €400

How does the IRS work on life insurance designed for retirement, such as Retirement Savings Plans (PPRs)? According to the article 21 of the Tax Benefits StatuteIt is possible to deduct 20% of the premiums paid for insurance from the IRS and there is a maximum limit for this deduction, according to the following table:

-

Age of the taxpayer

Maximum deduction

Premium amount to reach the maximum deduction

Under 35 years old €400 €2,000 From 35 to 50 years old €350 €1,750 He is over 50 and not retired €300 €1,500

Personal Accident Insurance with the IRS

> Deduction: 100% of premiums with a limit of 2,178.80

Only individuals in fast-moving professions are eligible for personal accident insurance with the IRS to be eligible for a tax deduction.

According to Section 27 of the IRS Code, anyone who is a fast-clothing professional can deduct 100% of premiums paid on personal accident insurance from their IRS. This deduction, however, is limited to five times the social support index (IAS) per taxpayer. In 2019, according to Ordinance 24/2019, the IAS is equal to 435.76 euros. Therefore the deductible limit will be equal to 2,178.80 euros.

Sportsmen, miners and fishermen are considered long-lasting professions.

Is there a limit on IRS deductions (including IRS deductions for insurance)?

The answer is yes. The total value of tax deductions and benefits from health and education expenses, tax bills, real estate expenses, and housing and food expenses is limited. Section 78 of the IRS Code contains information on this point.

There is a limit that cannot be exceeded depending on the taxable income of each family.

-

Collectible income

Deduction limit

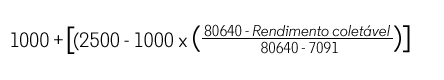

Up to €7,091 No limits From €7,091 to €80,640

More than 80,640 euros €1,000

It should be noted that families with 3 or more dependents (children, for example) will have their deduction limit increased by 5% for each dependent who is not an IRS taxpayer.

*The information in this article applies to IRS 2019, expiring in 2020.

latest posts published

What is botulism: everything about this dangerous disease

How to clean and care for your baby’s belly button?

How to detect and treat gastroenteritis in children?

At what age do the most common types of cancer appear?

Dyslexia in children: what is it, diagnosis and treatment?

Canker sores in children: symptoms and treatments

7 activities to do during the Christmas holidays with children

Self-employed: how much you will pay to Social Security

Know your rights and responsibilities as a worker