What would happen if your house was destroyed in an earthquake? And what would happen to your finances if, in this scenario, you were not reimbursed for your losses because you didn’t take out the right cover? Maybe it’s a not very pleasant thought, but one that you should take into account. To help you understand its importance, we will explain how seismic coverage works and why it is worth purchasing it.

We know that Portugal has a pending earthquake threat. It is not known how or when, but several experts point out that, at any moment, the earth will shake again, just as it happened in 1755.

This large historic earthquake reached a magnitude of approximately 8.75 on the Ritcher scale and caused a tsunami approximately 15 meters high, soil liquefaction phenomena and landslides, which left a trail of destruction, especially in Lisbon.

The material damage resulting from an event of this nature is incalculable. However, if it is not possible to predict when this will happen, it is possible to minimize the human, social and material consequences.

How to minimize the impact of an earthquake?

“Prevention is the best medicine” is a popular saying that applies perfectly in this case. And the best way to protect yourself is to take out multi-risk home insurance with coverage against seismic phenomena.

In Portugal there are approximately 3.8 million single-family homes with a multi-risk home insurance contract, of which only 19% are covered against seismic phenomena. Protect your home and your family from earthquakes with Casa da Assicurazioni General Peace of mindand guarantee, in the event of misfortune, the reconstruction of your assets.

What is seismic coverage?

This is an optional coverage of Multi-Risk Home Insurance which guarantees damage caused to insured goods following the direct action of earthquakes, volcanic eruptions, tsunamis, underground fires and fires resulting from these phenomena.

Phenomena and related damage that occur within a period of 72 hours from the occurrence of the first damage suffered by the insured property will be considered as a single claim.

How can this coverage protect me?

In the event of an earthquake, multi-risk home insurance with seismic coverage protects your home and its assets, guaranteeing:

> Demolition and rubble removal, up to the limit of the contracted capital;

> Filling of the property, up to the limit of the contracted capital;

> Reconstruction of the property, up to the limit of the contracted capital. If the contracted capital is sufficient to cover the damage caused by the earthquake, the reconstruction costs are fully covered. However, if it is insufficient, the insurer may apply the pro-rata rule and you will only be reimbursed for part of your losses.

The insurance company covers the costs of reconstruction of the property and its contents, up to the limit of the contracted capital. However, it is always up to the insured to pay the deductible defined in the contract, which can be equal to 5% or 10% of the insured capital.

Alternatively, if your home is completely destroyed by the earthquake, you can choose to be reimbursed for the amount owed and purchase another property.

How much does seismic coverage cost?

Multi-risk insurance provides a series of basic covers, to which it is possible to add other complementary covers. The premium is calculated based on the contracted coverage.

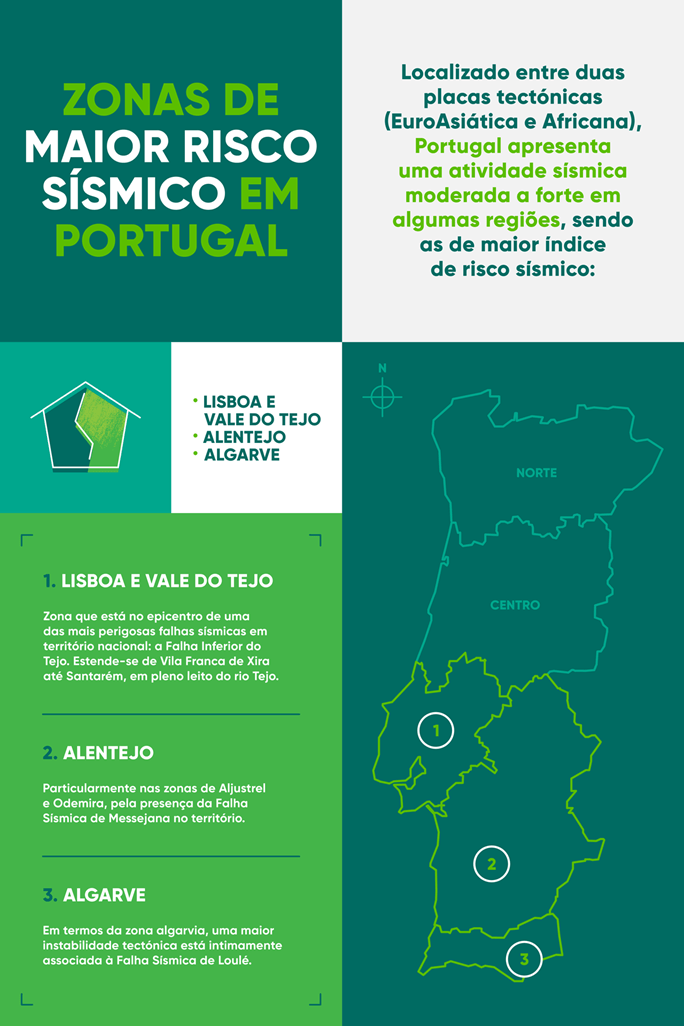

In the case of coverage for seismic phenomena, the price is calculated based on some factors, such as the age of the property, the area in which it was built and the seismic risk associated with it. In other words, the greater the seismic risk of the property area, and the older it is, the more expensive the coverage will be.

Infographic: Carlos Rocha

In addition to the indicators explained above, the amount to be paid also varies based on two very relevant factors: the insured capital (which corresponds to the value of the reconstruction of the property in the event of an accident) and the deductible (amount which is borne by the insured in the event of an accident) chosen to cover seismic phenomena and which can be equal to 5% or 10% of the insured capital.

In other words: the greater the value of the insured capital, the greater the value of the premium to be paid. However, the higher the deductible percentage you choose, the less you will have to pay for earthquake coverage.

It is also important to remember that if the contracted capital is lower than the reconstruction value, the compensation will not be sufficient to cover the damage and, in addition to having to pay the contracted deductible, you will still have to bear part of the losses.

Avoid hassles and remember: earthquakes are not covered by Multi-Risk Home Insurance, therefore, if you live in an area at risk of earthquakes, it is better to invest in seismic coverage to protect your home and your assets with Home Insurance. General Peace of mind.

![]()

latest posts published

What is botulism: everything about this dangerous disease

How to clean and care for your baby’s belly button?

How to detect and treat gastroenteritis in children?

At what age do the most common types of cancer appear?

Dyslexia in children: what is it, diagnosis and treatment?

Canker sores in children: symptoms and treatments

7 activities to do during the Christmas holidays with children

Self-employed: how much you will pay to Social Security

Know your rights and responsibilities as a worker